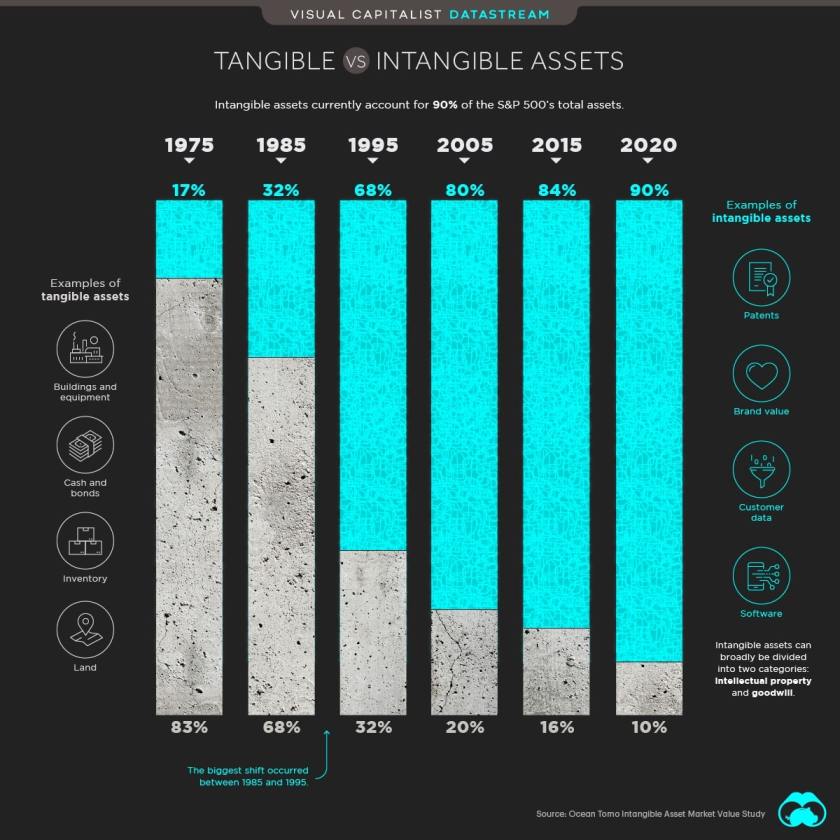

Dave Ahern Blog | Analyzing Intangible Assets and Their Impact To Assets and Operating Income | Talkmarkets

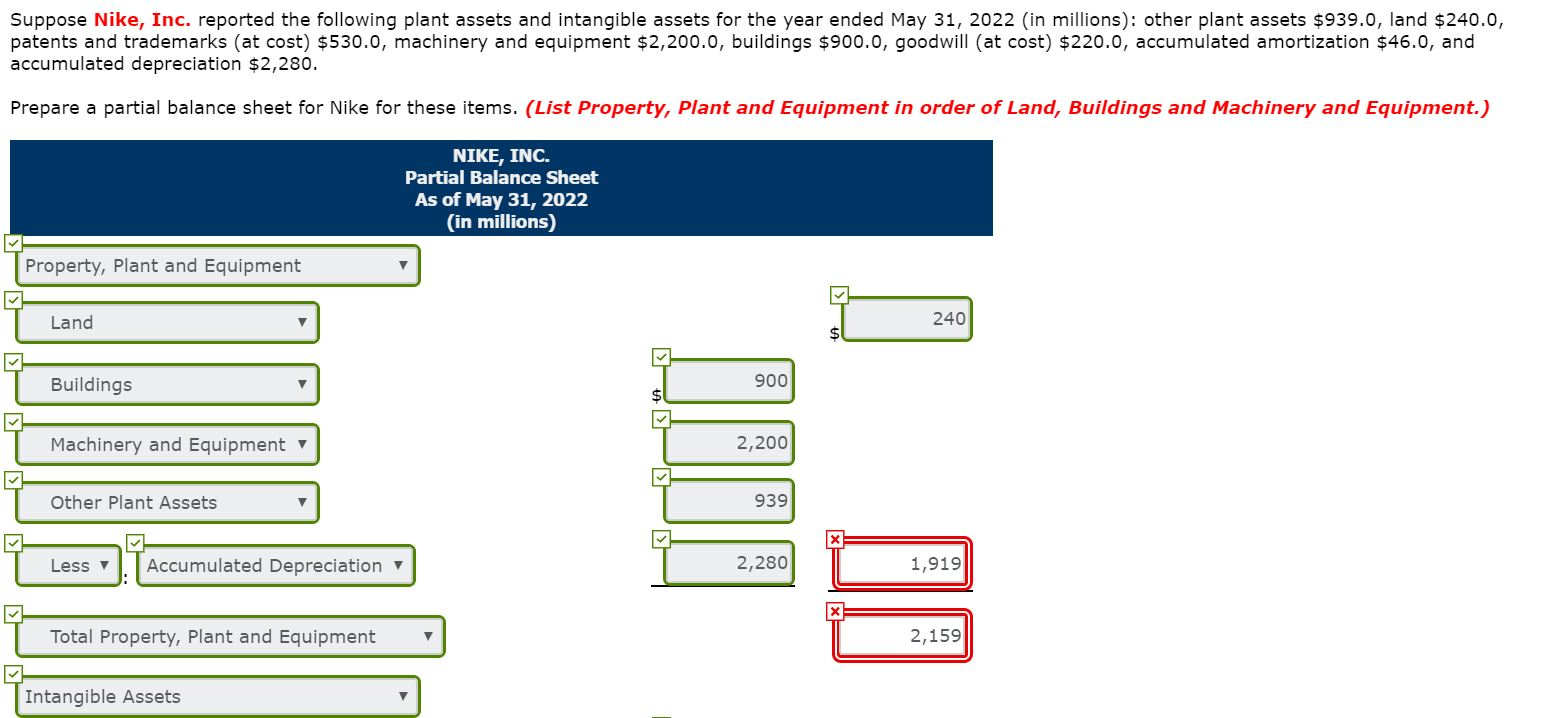

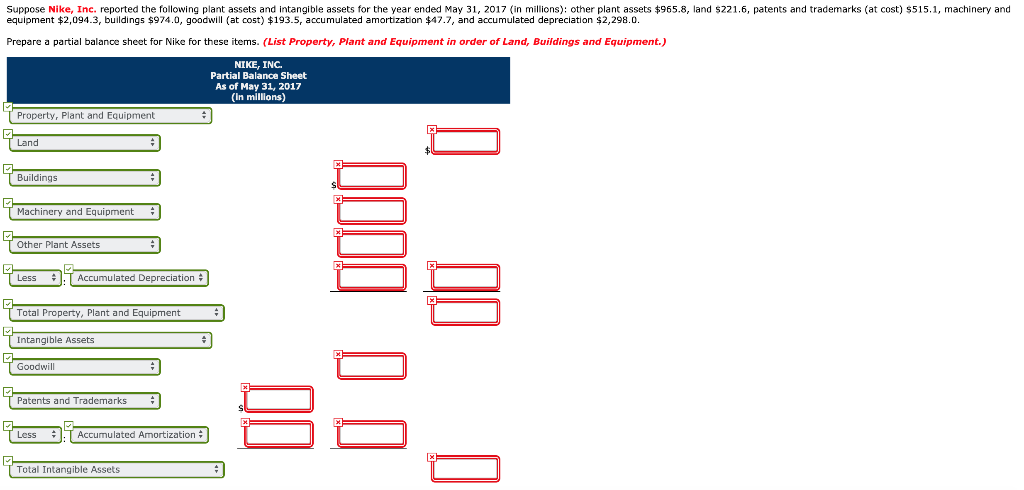

Nike, Inc.reported the following plant assets and intangible assets for the year ended May 31, 2022 - Brainly.com

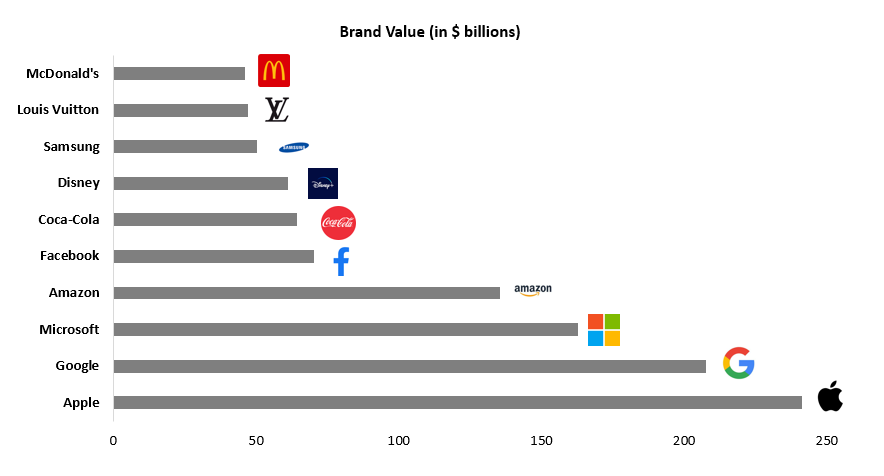

The Fashion Law on Twitter: "LVMH, Nike, L'Oreal among the top 100 most valuable companies in terms of intangible assets, per @BrandFinance. https://t.co/USkH1tKsl9 https://t.co/xYwL9Vk6gm" / Twitter

Brief Exercise 9-11 - Brief Exercise 9-11 Your answer is correct. Suppose Nike, Inc. reported the following plant assets and intangible assets for the | Course Hero